Slovak Battery Manufacturing: Transforming the Heart of Central Europe’s Industry

Big changes are afoot in Slovakia as we move further into 2024, with the country poised for a pivotal shift in its industrial scene. With the initiation of a massive €1.2 billion battery production site in Šurany—the nation’s second most significant investment in history—Slovakia is setting itself up as a pivotal player in Europe’s electric vehicle supply chain. Yet, the effects echo beyond the production figures, signaling a pivotal reorganization of not only local but regional industrial property and economic paradigms.

The synergy of automotive manufacturing prowess, Slovakia’s prime location, and hefty investments in battery production has sculpted a rare opportunity for the nation. Known for producing the highest number of cars per person worldwide—boasting 182 vehicles per 1,000 residents in 2024 ↗—this shift towards EV components isn’t merely a calculated move; it’s a necessity. The car industry, responsible for 13% of Slovakia’s GDP, must transition towards electrification to survive the changing tides.

This piece takes a closer look at how Slovakia’s burgeoning battery production landscape is reshaping industrial property markets, turning over supply chains, and opening new doors across Central and Eastern Europe. We’ll delve into market trends, investment trajectories, and strategic considerations for real estate stakeholders and manufacturers.

If you’re involved in industrial real estate, these transformations aren’t just a preview of a new manufacturing sector—they signal a profound reshaping of how industrial space is priced, used, and developed across Central Europe.

Current State of Slovak Battery Manufacturing and Electric Vehicle Batteries

In December 2023, Slovakia marked a significant milestone in battery production with InoBat kicking off the nation’s inaugural battery production line in Voderady ↗. Although its initial production was modest, with a capacity of 50,000 cells annually, this facility serves as Slovakia’s introductory step into advanced battery manufacturing. Its value lies not just in current output, but in proving Slovakia’s potential to host sophisticated manufacturing entities.

The game changed dramatically with the mid-2024 announcement of a partnership between China’s Gotion High-tech and Slovakia’s InoBat. This ambitious venture’s €1.2 billion investment will birth a vast 20 GWh battery plant over 65 hectares in Šurany. Set for trial production in 2026 and full-scale operations in 2027, this facility will employ roughly 1,300 people, placing Slovakia prominently on Europe’s battery supply chain map.

The timing couldn’t be more crucial. Giants like Volkswagen Group, Volvo Cars, and Kia already have substantial manufacturing facilities here, and the local demand for EV batteries is projected to hit record highs. Experts predict by 2027, around 40% of cars produced in Slovakia will be fully electric, ensuring a substantial local market for battery manufacturing.

In addition to InoBat and Gotion, numerous tier-two suppliers have rooted themselves in Slovakia’s western industrial zones, forming a budding ecosystem for battery components. These suppliers, focusing on battery management systems and thermal control units, occupy over 200,000 square meters in the regions of Trnava and Nitra, showing the industry’s rapid growth.

This wave of growth has significantly altered the demands of the industrial real estate sector. While traditional automotive suppliers might only require buildings with 15-20 meters of clear height and basic power infrastructure, battery makers now seek facilities with at least 25-30 meters of clear height, augmented power supply (often over 40 MW), and specialized storage zones for chemicals.

Economic Impact and Central Europe Real Estate Market Dynamics

The rise of Slovakia’s battery industry extends its economic impact well beyond the confines of traditional manufacturing. In 2024, 993,000 vehicles were produced by the Slovak automotive sector, an 8% dip from 2023’s figures. Yet, this decline masks a pivotal shift as manufacturers retrofit their lines for electric vehicles, boosting the need for locally-made batteries.

Investments in battery production catalyze a ripple effect in the industrial real estate market. For every square meter devoted to battery production, about 2.5 square meters of supplier space is essential. This ratio, notably surpassing the 1:1.8 ratio seen in traditional automotive manufacturing, is pushing unparalleled demand for industrial real estate in Slovakia’s western regions.

The employment landscape is undergoing a similar transformation. Battery manufacturing facilities need a different workforce profile compared to traditional car plants. The average salary at these battery facilities stands 22% higher than at conventional automotive plants, emphasizing the necessity for more technically skilled employees. This wage discrepancy affects real estate location decisions, with developers prioritizing areas with robust tech education systems.

Property values have also experienced dramatic shifts. Paramount industrial plots—those with excellent transportation links and strong power infrastructure—have appreciated by 35-45% between 2023 and early 2026. This surge reflects both the scarcity of suitable land and the strategic significance of securing sites within Slovakia’s burgeoning battery corridor.

There’s also been a notable shift in foreign direct investment patterns. While German, French, and Korean interests previously dominated automotive investments, battery production is drawing considerable Chinese investment. This diversification creates fresh dynamics in real estate development, with Chinese investors frequently opting for build-to-suit deals instead of the traditional lease agreements.

Infrastructure and Real Estate Requirements

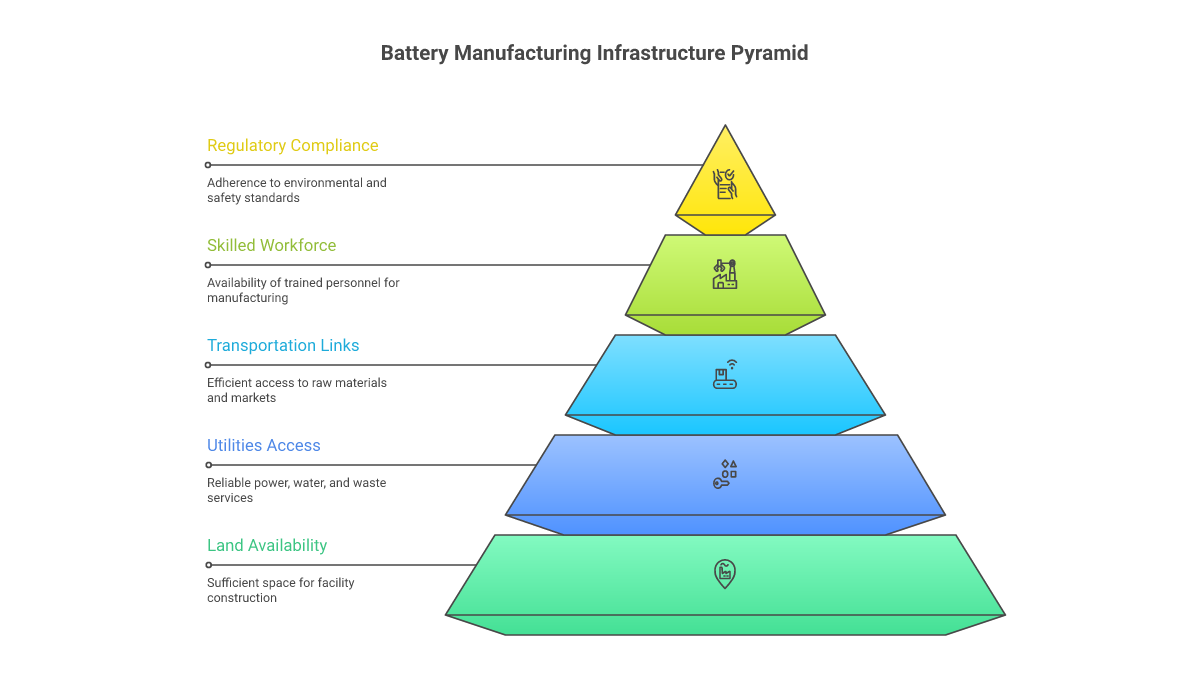

The infrastructure demands of battery production facilities surpass anything traditional manufacturing requires. Highlighting these new standards is the Gotion-InoBat site in Šurany. Spanning 65 hectares, this location needs dedicated high-voltage power infrastructure capable of 40+ MW sustained loads, nearly three times what conventional car plants require.

Water availability is another critical consideration. Battery production demands about 2.5 cubic meters of process water for each MWh of battery capacity. This translates into substantial water infrastructure requirements for a 20 GWh facility like the one in Šurany. Developers are increasingly incorporating water treatment and recycling into their plans, which raises construction costs and site needs significantly.

Transportation requirements have also evolved. While traditional automotive industries needed excellent road links, battery manufacturers seek multimodal transport options. Rail access has become pivotal due to the bulk arrival of raw materials by train, and the shipment of completed batteries across Europe with minimal handling risks.

The architectural specs for battery plants differ greatly from conventional industrial sites. Building heights often stretch to 25-30 meters to house automated storage and retrieval systems. Floor loads should exceed 5 tons per square meter, compared to 2-3 tons in regular facilities. These changes are reshaping industrial development as many current sites can’t easily convert to battery use.

Environmental control is another pivotal concern. Battery production requires stringent temperature and humidity regulation, with more confined tolerance levels than other industries. This translates to advanced HVAC systems and tighter building envelopes, boosting construction costs by 25-40% over standard industrial properties.

Supply Chain Integration and Global Supply Chain Dynamics

Slovakia’s rise as a leader in battery manufacturing is reshaping regional supply chain dynamics. The strategic site of Šurany, with access to some 45 million consumers within a 500-kilometer radius, illustrates the strategic foresight in choosing locations. This placement enables manufacturers to serve a broad spectrum of European automotive plants effectively while keeping inventory levels manageable.

Battery supply chains diverge starkly from traditional automotive practices. While car supply chains typically embrace just-in-time methods with frequent deliveries, battery production hinges on larger raw material inventories and more intricate storage solutions. This shift necessitates specialized warehouses with advanced safety and environmental controls.

Logistics are adapting to these new demands. Rail logistics have seen a resurgence, with manufacturers favoring sites boasting rail connections. Transporting finished batteries, classified as hazardous materials, requires dedicated handling and storage facilities, spurring the growth of specialized logistics hubs along key routes.

The integration of battery manufacturing into existing automotive supply chains is fostering new industrial real estate clusters. Suppliers now tend to situate near battery production plants rather than final assembly lines, sparking new patterns of demand for industrial space. This clustering has led to the development of specialized parks geared towards battery-related manufacturing and logistics.

Cross-border supply chain integration presents both opportunities and hurdles. Slovakia’s central position makes it an ideal springboard for many European markets, but differing regulatory and infrastructure norms across borders can make logistics planning tricky. Developers are responding by designing versatile space configurations that cater to varied regulatory landscapes.

Future Growth Projections and Slovakia Economic Challenges

As Slovakia looks toward 2027-2030, its battery sector contends with both exciting prospects and formidable challenges. Predictions suggest total battery production could soar to 45 GWh by 2030, necessitating another 300-400 hectares of industrial land. This growth would solidify Slovakia’s crucial role in Europe’s EV supply chain.

Workforce development remains a crucial hurdle. The sector could generate 3,500-4,000 direct jobs by 2030, plus an additional 7,000-8,000 roles in supporting fields. But, the technical skills needed for battery production are in short supply. While education programs are being developed in collaboration with manufacturers, the delay between training and availability could stifle growth.

Infrastructure is another potential stumbling block. Although current grid upgrades meet immediate needs, projected industry growth will demand further substantial infrastructure investments. Early estimates suggest €3-4 billion in grid improvements will be necessary by 2030 to fully support this expanding industry.

Environmental factors gain increasing importance. While battery manufacturing advances sustainability by enabling EV adoption, the actual production process poses environmental challenges. Facilities will need to comply with rigorous environmental standards, which could increase costs and prolong development timelines.

Competition from other Central European areas is heating up. Nations like Hungary and Poland are also enhancing their battery capacities, creating a more competitive landscape for investments and skilled workers. Slovakia’s ongoing success will depend on sustaining its edge in infrastructure, workforce quality, and strategic location.

Conclusion

Slovakia’s evolution into a key battery production hub signifies more than just industrial growth; it represents a sweeping transformation of Central Europe’s economic fabric. The €1.2 billion investment by Gotion-InoBat marks the dawn of a new industrial era, one requiring substantial shifts in the development and management of industrial real estate.

For those navigating the industrial real estate waters, the message is clear: conventional methods must evolve to address the unique challenges of battery production. Successful navigation of this new landscape demands understanding beyond property fundamentals—it requires an insight into the intricate dance of supply chain dynamics, workforce development, and infrastructure requirements.

As Slovakia stakes its place at the cutting edge of Europe’s electric vehicle shift, the potential for strategic investment in industrial real estate and the broader automotive sector is immense. But to unlock these opportunities, stakeholders must carefully weigh the sector’s unique challenges and needs. The next five years will be pivotal in determining whether Slovakia can fully rise to its potential as a top-tier battery manufacturing hub.