The Evolution of Warehouse Listing Marketplaces in Slovakia: A Comprehensive Guide for Skladové priestory prenájom

By 2025, Slovakia’s industrial real estate landscape experienced a significant breakthrough, achieving an impressive €970 million in investment volume. This remarkable figure, documented in the report ↗, marks the second highest on record. It’s not just about the increased volume of transactions, but about how businesses are now finding, assessing, and securing these warehouse spaces.

The timing could not have been better. As the total modern warehouse and production space in Slovakia surpassed an incredible 4.83 million square meters ↗ by Q4 2025, the old ways of finding and securing industrial space just don’t cut it anymore. The increasing complexity of the market, coupled with the rising expectations of tenants, demands more advanced tools for discovery and comparison.

This analysis dives into how digital marketplace aggregation is reshaping the leasing of warehouses in Slovakia. It examines the technological leaps, market shifts, and strategic consequences for everyone involved in the industrial real estate sector. From AI-driven algorithms that match properties to virtual tours offering immersive experiences, we’ll explore the tools and strategies that are carving out the future of industrial space procurement.

For logistics operators eyeing expansion, industrial property owners aiming to maximize occupancy, or real estate pros trying to keep up with this changing sector, understanding these marketplace dynamics is key to thriving in 2026 and beyond.

Current Market Dynamics and Digital Transformation in Warehouse Space

Slovakia’s industrial real estate market stands at an intriguing crossroad. CBRE’s latest analysis for Q1 2025 revealed a shift in market power, with vacancy rates climbing to 8.2% in key logistics hubs. This scenario fosters the perfect climate for digital innovation, as both property owners and tenants search for more efficient ways to connect.

The traditional routes for finding warehouse space, usually dependent on broker networks and direct deals, made up only 52% of new leases in 2025, dropping from 78% in 2022. This sharp decline signals the market’s technological transformation, with online platforms facilitating a staggering €425 million in lease transactions that year.

The rise in digital platform use aligns with the boom in Slovakia’s logistics sector. By 2026, the national freight and logistics market is projected to grow from USD 9.06 billion to USD 9.29 billion, fueling a steady demand for skladové priestory prenájom (warehouse space rental). This growth has drawn hefty investments in digital infrastructure, with platforms securing €67 million in venture capital funding ↗ throughout 2025.

What stands out is the regional uptake of these digital platforms. Western Slovakia, historically a logistics stronghold, leads with 63% of listings now found online. Meanwhile, central and eastern regions show increasing adoption rates of 48% and 41%, underscoring the nationwide breadth of this transformation.

The impact isn’t just in finding space. Today’s digital marketplaces offer layered data analytics, giving insights into trends, pricing, and occupancy. This transparency is a game-changer, with 72% of tenants in 2025 saying that digital platform data heavily influenced their location decisions.

Key Features and Technological Integration in Industrial Property Leasing

The landscape of warehouse marketplace platforms in Slovakia has dramatically advanced beyond simple listings. These platforms have transformed into comprehensive ecosystems, thanks largely to technological integration. At the forefront is artificial intelligence, which powers algorithms that pair tenants with the right spaces with 85% accuracy—leagues better than the 45% accuracy of older methods.

Virtual reality tours have become a standout feature, with 64% of initial property viewings now happening virtually. This advancement has cut the average lease completion time by 37% and slashed the need for physical tours by 58%. Properties with virtual tours have seen interest levels more than double compared to those with just pictures.

Data integration within these platforms has reached new heights. Real-time monitoring across Slovakia’s logistics corridors provides tenants with unparalleled market transparency. Tenants can now track daily rate changes across 122 micro-markets, helping them time their lease negotiations perfectly.

Adding another layer of functionality, building management system (BMS) data integration now allows for insights into a property’s past utility use, maintenance history, and operating costs. Such transparency has slashed post-lease disputes by 42%, according to studies conducted in 2025.

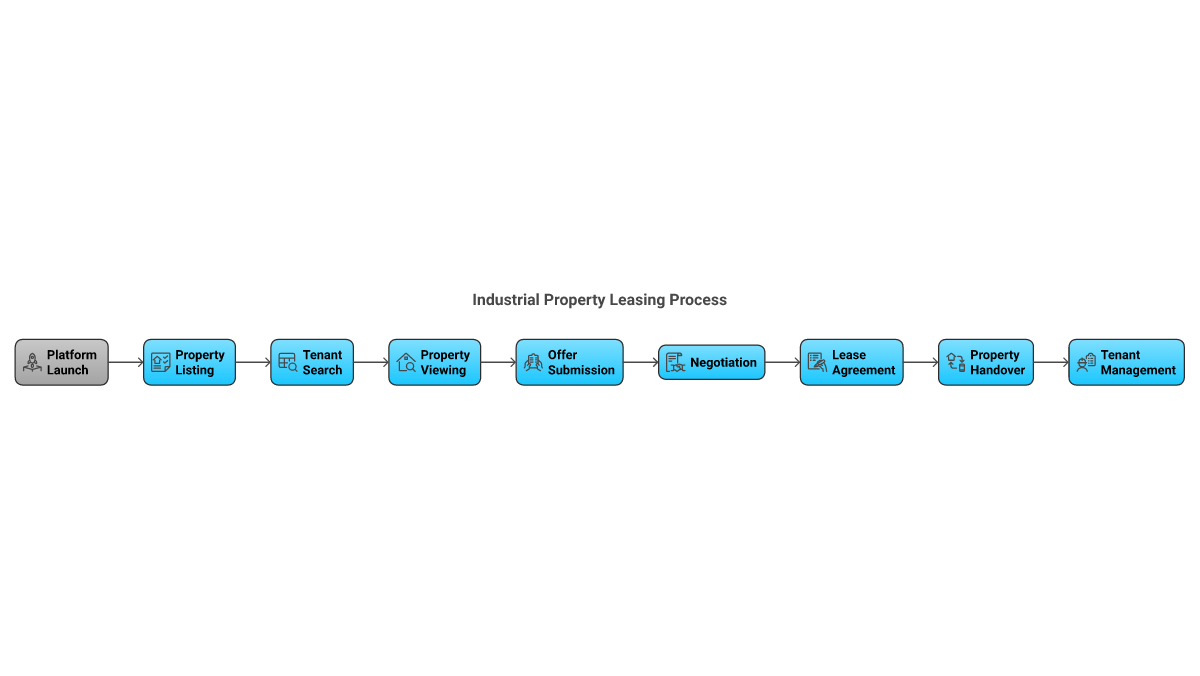

Automation in document processing and digital management of transactions has further streamlined leasing. The period from initial inquiry to lease signing fell from an average of 76 days in 2024 to a mere 31 days in 2025 for those using digital platforms.

Market Impact and Efficiency Gains

Warehouse marketplace platforms have reshaped Slovakia’s industrial property market dynamics at every level. Average transaction costs have dropped by 23%, as digital platforms eliminated many traditional fees from intermediaries. This efficiency translated into €34 million in direct tenant savings throughout 2025.

Vacancy periods underwent notable improvements, dipping from an average of 4.2 months in 2024 to just 2.8 months in 2025 for listings on digital platforms. This efficiency not only benefits tenants but also added an estimated €78 million to landlords’ revenue due to shorter vacancy times.

Real-time pricing data now covers 83% of Slovakia’s industrial real estate, contributing to more transparent markets. This clarity has narrowed the bid-ask spread by 31% versus traditional systems, fostering more efficient negotiations and shorter deal closure times.

The improved liquidity in the market is particularly striking. Lease transaction times dropped by 42% in 2025, with a 156% rise in qualified leads per listing. This increased liquidity has brought in €187 million in new institutional investments, with market efficiency cited as the primary attraction.

Not to be overlooked, the move to digital platforms has brought an environmental bonus. The steep drop in physical site visits saved around 425,000 kilometers of travel in 2025, cutting 68 metric tons of CO2 emissions in the process.

Challenges and Future Developments

Despite the benefits, Slovakia’s digital lease transformation still faces hurdles. Data standardization is a major issue, with only 58% of listings in 2025 adhering to the Slovak Industrial Property Data Standard (SIPDS). This fragmentation hinders cross-platform comparisons and comprehensive market analysis.

Security concerns are also on the rise, as platforms handle more sensitive business data. The Slovak National Cyber Security Center recorded 17 attempted breaches of real estate platforms in 2025, underscoring the urgent need for strong security measures.

Bridging the gap with legacy systems presents its own challenges. While 72% of new properties can easily sync with digital platforms, older facilities often lack digital capabilities, requiring costly retrofitting at about €4.2 per square meter.

The human touch remains essential, with 65% of deals needing significant offline interaction despite being initiated digitally. This hybrid approach requires a balance between automation and personal service, a challenge digital platforms are addressing with AI-driven customer support.

Looking forward, emerging technologies are set to transform the marketplace further. Blockchain-based smart contracts are under trial by three major platforms, potentially slashing transaction times by another 40%. Meanwhile, augmented reality is expected to revolutionize virtual property tours by 2027.

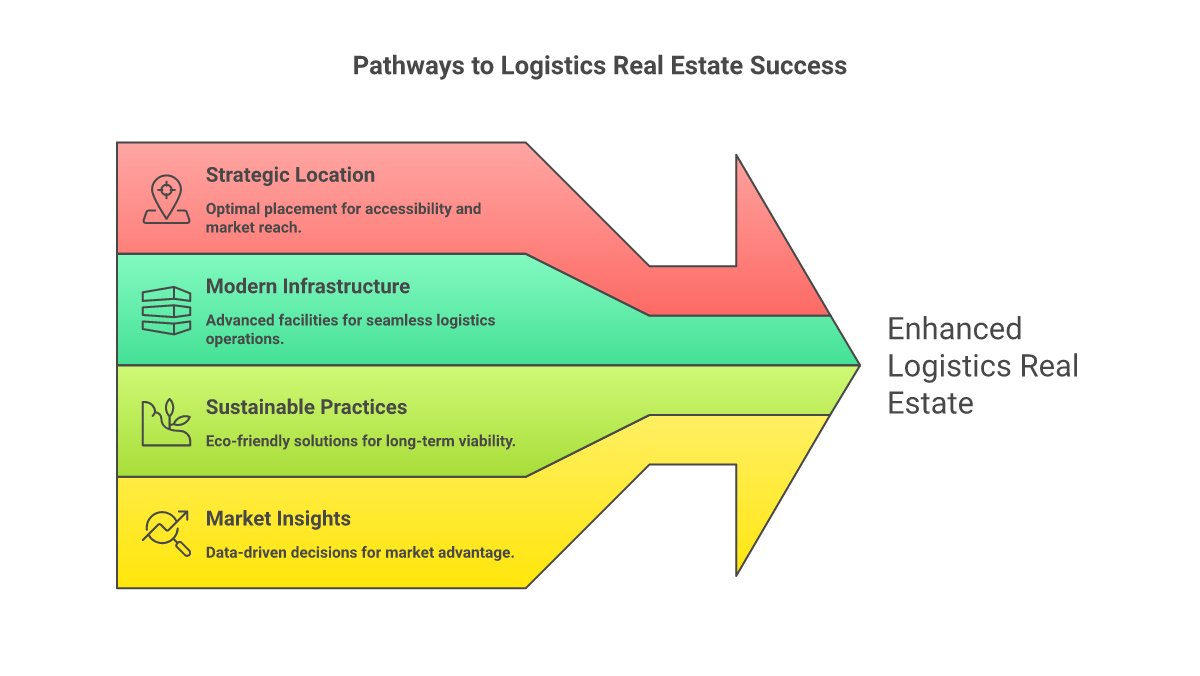

Best Practices for Logistics Real Estate Market Participants

Adapting to Slovakia’s evolving warehouse marketplace requires strategic finesse from all stakeholders. Property owners investing in digital upgrades experienced 27% more inquiries in 2025 than those sticking to traditional listings, leading to 18% faster lease signings and 12% higher rental rates.

Data quality has emerged as a critical factor for success. Properties with comprehensive digital documentation, like BIM models and detailed specs, garnered 3.2 times more inquiries than those with basic listings. The ROI on creating detailed digital assets averaged an impressive 312% in 2025.

Integrating with enterprise resource planning (ERP) systems is becoming crucial. Companies that linked their logistics planning software directly to marketplace platforms shortened their space procurement cycles by 52%, leading to average annual savings of €2.3 million for large operators.

Regularly monitoring the market through digital platforms has become essential for staying competitive. Companies using automated intelligence tools identified favorable lease opportunities 45 days sooner than those relying solely on traditional research.

Developing in-house digital expertise is key, with 78% of successful market players in 2025 having dedicated teams or specialists for digital real estate efforts.

Conclusion and Future Outlook

The transformation of Slovakia’s warehouse marketplace scene marks a pivotal shift in industrial real estate operations. With €970 million in investments and digital platforms accounting for 48% of transactions in 2025, the push towards digital-first strategies seems unstoppable.

For those in the market, the message is clear: embrace digital transformation or face falling behind. Data shows that early adopters of full digital strategies secured 23% better terms on average in 2025 compared to traditional players. As technology progresses and market expectations evolve, this advantage is likely to grow.

As we look to 2027 and beyond, incorporating artificial intelligence, blockchain, and augmented reality may further reshape how skladové priestory prenájom (warehouse space rental) is managed in Slovakia’s commercial property market. Companies investing in digital capabilities now will be best positioned to seize future opportunities in this dynamic industry.